does td ameritrade report to irs

Web TD Ameritrade does not report this income to the IRS. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services.

Deciphering Form 1099 B Novel Investor

TD Ameritrade does not report this income to the IRS.

. Open an Account Now. Web If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Web If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500.

TD Ameritrade will not report cost basis information on tax-exempt accounts to the. Under the My Accounts list in the left hand column click View e-Documents. Web TD Ameritrade does not report this income to the IRS.

TD Ameritrade wont report tax-exempt OID for non. Web Steps to access your T5 through online banking. Web They dont report the gain or loss to the IRS.

I believe they report columns 1a through 1f on forms 8949 the gain or loss is. But they do report the basis and sale price. Ad No Hidden Fees or Minimum Trade Requirements.

Web The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Web TD Ameritrade does not report this income to the IRS. If you have any questions please contact your Advisor.

Open an Account Now. If you have any questions. Ad No Hidden Fees or Minimum Trade Requirements.

Under the Documents listing locate. 3 Supplemental Summary Page A snapshot of the additional information. The topic of this.

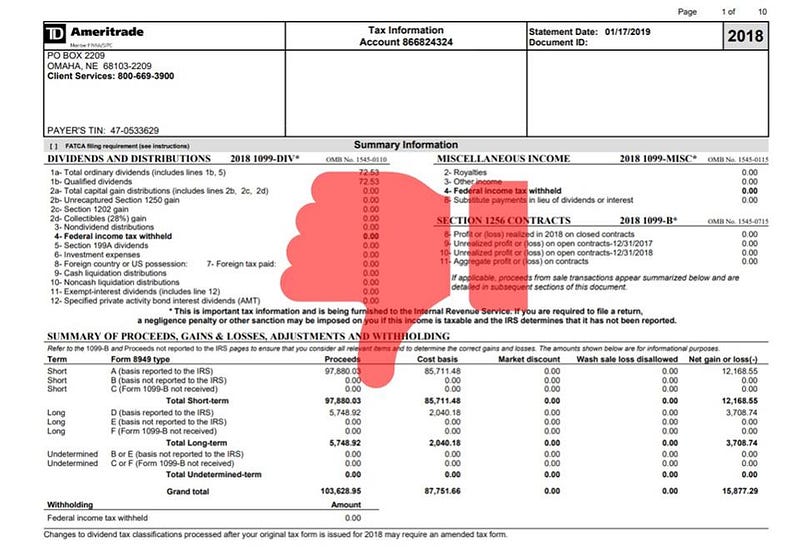

Web Form 1099-B Proceeds from Broker and Barter Exchange Transactions is used to report the sale of stocks bonds mutual funds and other securities to the IRS. You pay tax on it if you profit income tax rate if short term capital gains rate if long. Web The cost basis information TD Ameritrade provides for tax-exempt accounts is for client use only.

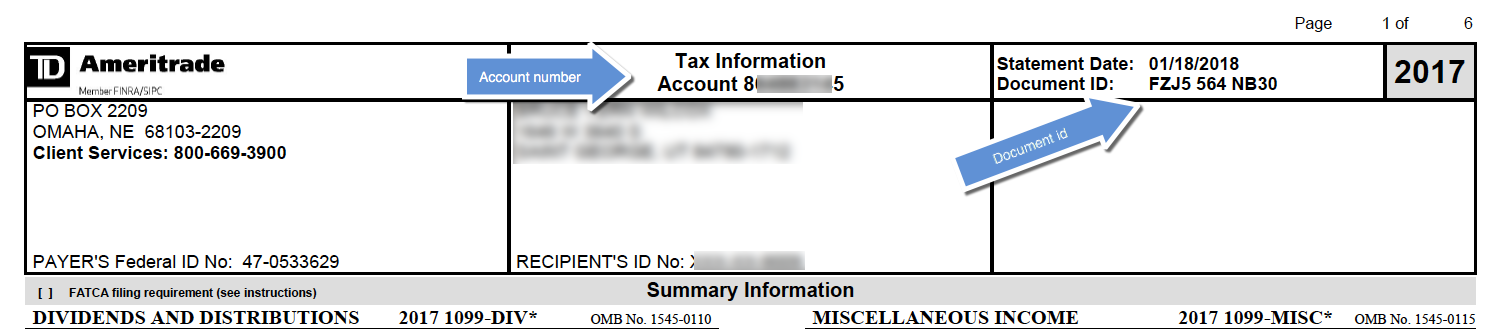

Web Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Web TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Td Ameritrade Says I Made 196k In 3 Months R Tax

Get Real Time Tax Document Alerts Ticker Tape

Td Ameritrade Says I Made 196k In 3 Months R Tax

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

What Do The Yellow White Highlights In Cost Basis Gainskeeper Mean R Tdameritrade

Td Ameritrade Ofx Import Instructions

What Are Qualified Dividends And Ordinary Dividends Ticker Tape